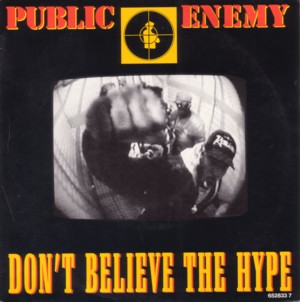

Today the NAR came out with a report showing that the volume of home sales in many parts of the country is up. This has lead many in the media to declare that the housing market has hit a bottom and is now recovering. Don’t believe the hype. Rising volume on lower pricing is not an indication of a bottom, it is an indication that you should not try to “catch a falling knife” in the parlance of a trader.

Today the NAR came out with a report showing that the volume of home sales in many parts of the country is up. This has lead many in the media to declare that the housing market has hit a bottom and is now recovering. Don’t believe the hype. Rising volume on lower pricing is not an indication of a bottom, it is an indication that you should not try to “catch a falling knife” in the parlance of a trader.

The housing market is just that – a market. Though it is different than the stock market in many ways, price discovery occurs through the same process of supply and demand. The main difference is that price discovery in the housing market takes much, much longer. This is mainly due to the fact that stocks, generally, provide liquidity and similarity, i.e. there is no difference between one GE share and the next. Each house is different, but areas can be grouped and viewed similar to different sectors of stocks, with each house in that sector being a different class of stock – common, preferred, convertible preferred, etc. So the question is; just because there is a higher volume of trading on lower pricing, does this mean we are finding a bottom or simply overreacting to all of the hype in the media about the number of short sales and bank owned properties available at 50% off?

Another difference is that there is far more market manipulation in the housing market by government agencies than in the stock market. Without Fannie and Freddie and FHA buying and insuring mortgages and Mr. Obama giving away $8K to every first time homebuyer to create a new wave of 100% financing, where do you think the real market price would be? Im guessing it would be much lower.

It will be interesting to see what happens to prices and volume once the $8000 first time buyer credit ends on November 30th.