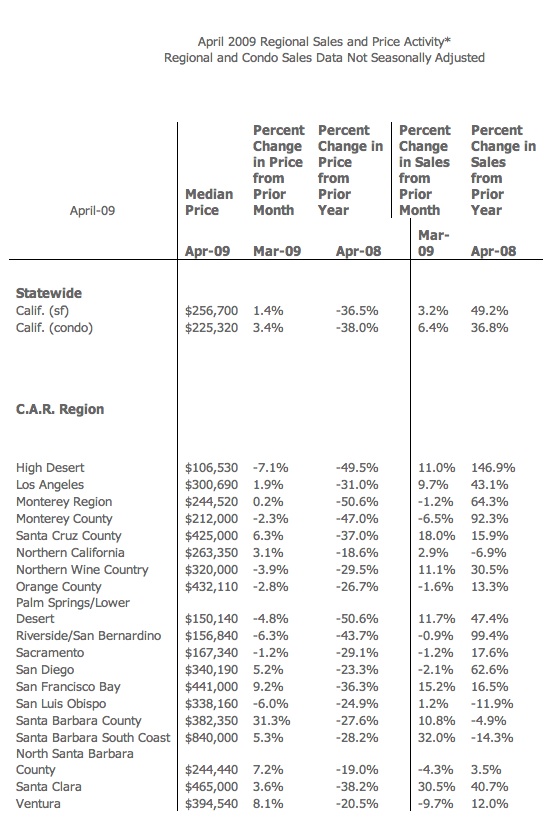

In April, California home sales were up and prices were down, and C.A.R. has the stats to prove it, “Home sales increased 49.2 percent in April in California compared with the same period a year ago, while the median price of an existing home declined 36.5 percent, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) reported today.” Orange County is listed on the C.A.R. chart to the right.

Now is the time to snap up a short sale and trust me you aren’t the only person in the state thinking about it, James Liptak, C.A.R. President, says, “The dramatic difference in inventory exemplifies how the low end of the market is attracting more first-time buyers and investors, creating a shortage of distressed properties for sale.” A SHORTAGE. When was the last time you heard that word used when talking about homes for sale?! C.A.R.’s Chief Economist, Leslie Appleton-Young, is sounding eerily similar to what Lawerence Yun, NAR Chief Economist, was quoted saying in the WSJ (See: New Neighbors). Appleton-Young says,

Favorable home prices in many parts of the state have led to an increase in affordability for first-time buyers. In the first quarter of 2009, affordability rose to 69 percent, enabling many to take advantage of first-time buyer programs and near record-low interest rates,” said Appleton-Young. The jumbo loan market, however, continues to be starved for financing, constraining sales for the high-end segment.

If that’s not enough to get you going and you’re still not sure if you want to seek out a short sale check out some of the homes up for grabs and see how little of your hard earned cash you’d need to take a short sale property from distressed home to home-sweet-home.

Minda Reves is a freelance blogger for SHORTsense.com

The reports are in and

The reports are in and

In the optimistically titled article, “

In the optimistically titled article, “ Zillow.com has some disheartening news to share, “

Zillow.com has some disheartening news to share, “ Real Estate agents, homeowners, buyers and communities across the nation just can’t make sense of it, if a short sale is more beneficial to everyone involved, including the banks, then why are foreclosures more prevalent in the marketplace? Trust me, the banks aren’t doing you any favors by granting you a

Real Estate agents, homeowners, buyers and communities across the nation just can’t make sense of it, if a short sale is more beneficial to everyone involved, including the banks, then why are foreclosures more prevalent in the marketplace? Trust me, the banks aren’t doing you any favors by granting you a