According to a report this morning by Ruth Simon at the WSJ, The Obama administration is urging loan servicers to up the ante on their loan modification efforts. Treasury Secretary Geithner and HUD Secretary Donovan sent a letter out to 25 loan servicers urging them to “devote substantially more resources to this program”.

More than 270,000 borrowers have received modification offers under the program. But housing counselors complain many borrowers are waiting for help as mortgage-servicing companies get up to speed. The administration has said its program could help as many as

four million homeowners.

The administration has “started to see a significant ramp-up” in modification activity, the letter said. But it added, “there appears to be substantial variation among servicers in performance and borrower experience.” It called on mortgage-servicing companies to beef up staffing and training, and to provide “an escalation path for borrowers dissatisfied with the service they have received.” Freddie Mac, which serves as compliance agent for the program, will be developing a “second look” process in which it will audit a sample of rejected modification applications, the letter said.

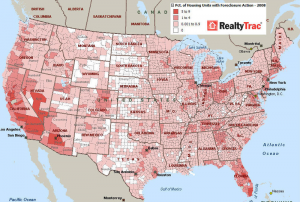

This letter demonstrates the Keynesian mindset of the Obama administration in trying to deal with the so called “crisis” in the housing market. The housing market is not in crisis. The housing market is in perfect form as it cold-heartedly deleverages itself after 5 years of greed and risk-free speculation. If this is a crisis, then the government should be setting up shelters for people that bought a home with no money down and claimed they made $20K a month as a “food services advisor”. Instead, they are enabling them to continue to live a life of making bad decisions with no consequences.

Sending warning letters to loan servicers won’t fix the problem, it will only extend the problem and ensure a steady supply of short sales and bank-owned homes for a few more years. The problem is that people are living in homes that they can’t afford, even if their loans are modified to 0%.

In order to fix the problem, we need to have government step out of the way and let the free market go to work to clear the inventory. Yes, people will lose their homes. Yes, there will be more pain. But ultimately, it will be better for all Americans as the economy will recover faster and the people that lost their homes will have jobs to save up for a down payment on a home they can afford.

Need help? Contact Short Sale Agents

Peter Hong of

Peter Hong of

“Home prices continued to tumble in April, falling 18.1% from a year earlier — but the change from March narrowed sharply, indicating that housing markets may be starting to turn.” That little burst of sunshine is from

“Home prices continued to tumble in April, falling 18.1% from a year earlier — but the change from March narrowed sharply, indicating that housing markets may be starting to turn.” That little burst of sunshine is from  We reported it here first folks, short sales will work if you have the right agent and the right paperwork in place. Now, the

We reported it here first folks, short sales will work if you have the right agent and the right paperwork in place. Now, the  Hello, we are in a recession. Most people seeking out a short sale don’t need an eBook they need an eRescue! And any savvy homeowner knows the right realtor is what really makes the difference. Heck, even the supposed Orange County authors of the book, Should

Hello, we are in a recession. Most people seeking out a short sale don’t need an eBook they need an eRescue! And any savvy homeowner knows the right realtor is what really makes the difference. Heck, even the supposed Orange County authors of the book, Should